Census Bureau’s 2022 Poverty Data

Analyzing the Census Bureau’s 2022 Poverty, Income, and Health Insurance Data

By: Center on Budget and Policy Priorities

Date: September 12th, 2023

If Child Tax Credit Expansion Had Been Renewed, 3 Million Fewer Children Would Have Been in Poverty in 2022

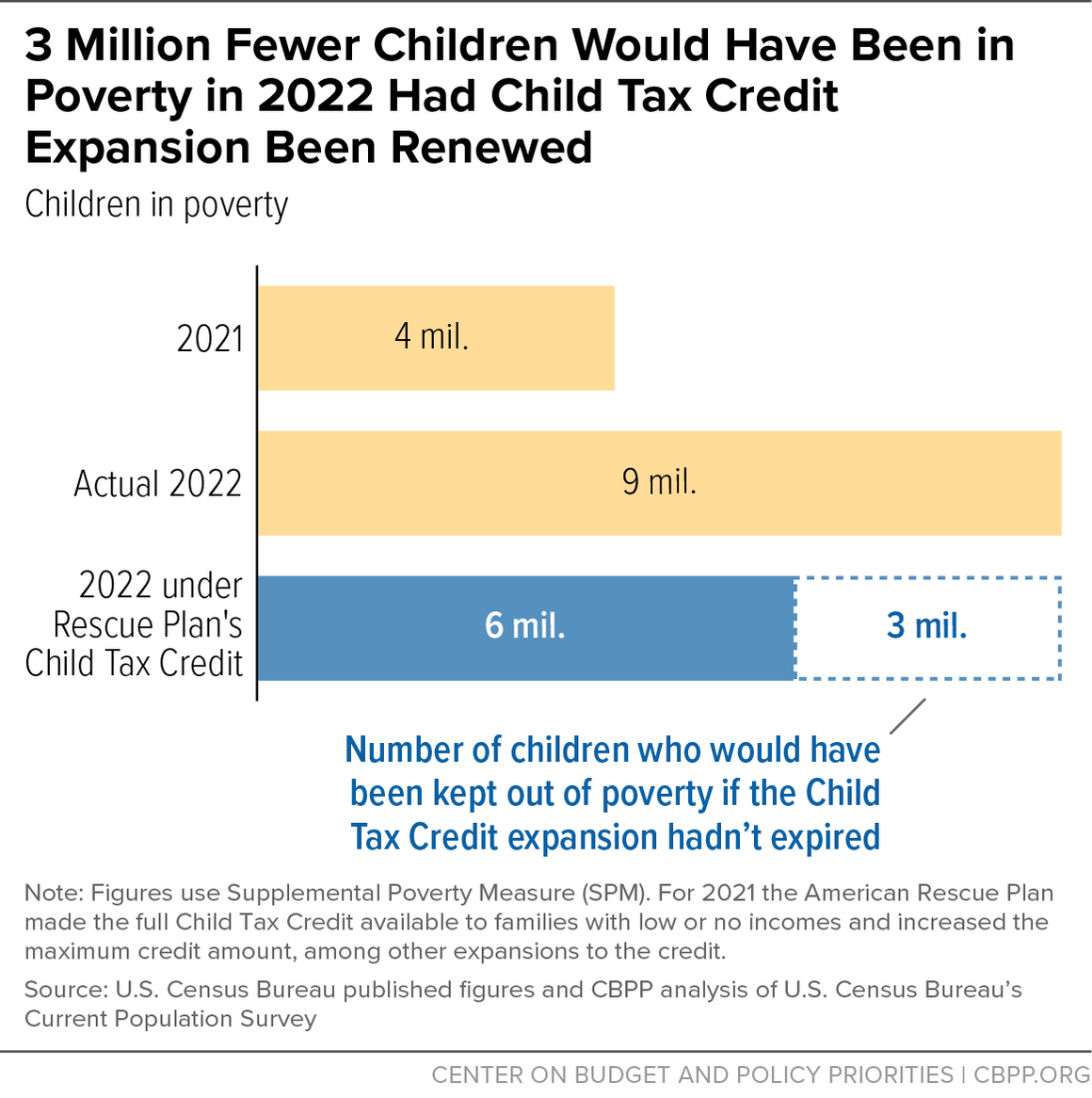

Driving the historic rise in child poverty in 2022 was the expiration of pandemic-era relief programs, including Congress’s decision to allow the expiration of the 2021 Child Tax Credit expansion. Renewing the expansion — which President Biden and many in Congress supported — would have kept about 3 million children above the poverty line in 2022, avoiding more than half of the actual rise in child poverty, we calculate using Census data released today. The child poverty rate in 2022 would have been about 8.4 percent rather than 12.4 percent.

Instead, the number of children in poverty more than doubled, from 4 million in 2021 to 9 million in 2022.

The Rescue Plan’s Child Tax Credit expansion raised the maximum credit amount from $2,000 to $3,600 for children under 6 and to $3,000 for children aged 6-17 (the first time 17-year-olds were included). Most importantly, for the first time, it made the Child Tax Credit “fully refundable,” meaning the full credit was available to children in families with low or no earnings.

When the expansion expired at the end of 2021, the credit reverted to the flawed design in place under the prior law — namely that the families who need help the most get less than middle- and higher-income families. Given that this flawed design remains in place today, it’s likely that these higher child poverty rates will continue beyond 2022 unless Congress acts.

An estimated 19 million children — or more than 1 in 4 children under age 17 — get less than the full Child Tax Credit or no credit at all under current law because their families earn too little, while families with much higher incomes (up to $400,000 for married couples) receive the full $2,000 credit for each child.

Another major factor in the increase in poverty in 2022 was the expiration of pandemic stimulus payments, which were meant to be temporary. The Rescue Plan’s stimulus payments provided $1,400 per person and kept a similar number of children above the poverty line in 2021 as the Child Tax Credit expansion.

Historic Increase in Child Poverty Driven by Expiration of Pandemic Relief

Today’s Census figures show a historic increase in poverty in 2022 driven by the expiration of pandemic assistance including the American Rescue Plan’s Child Tax Credit expansion, according to Census’ Supplemental Poverty Measure (SPM).

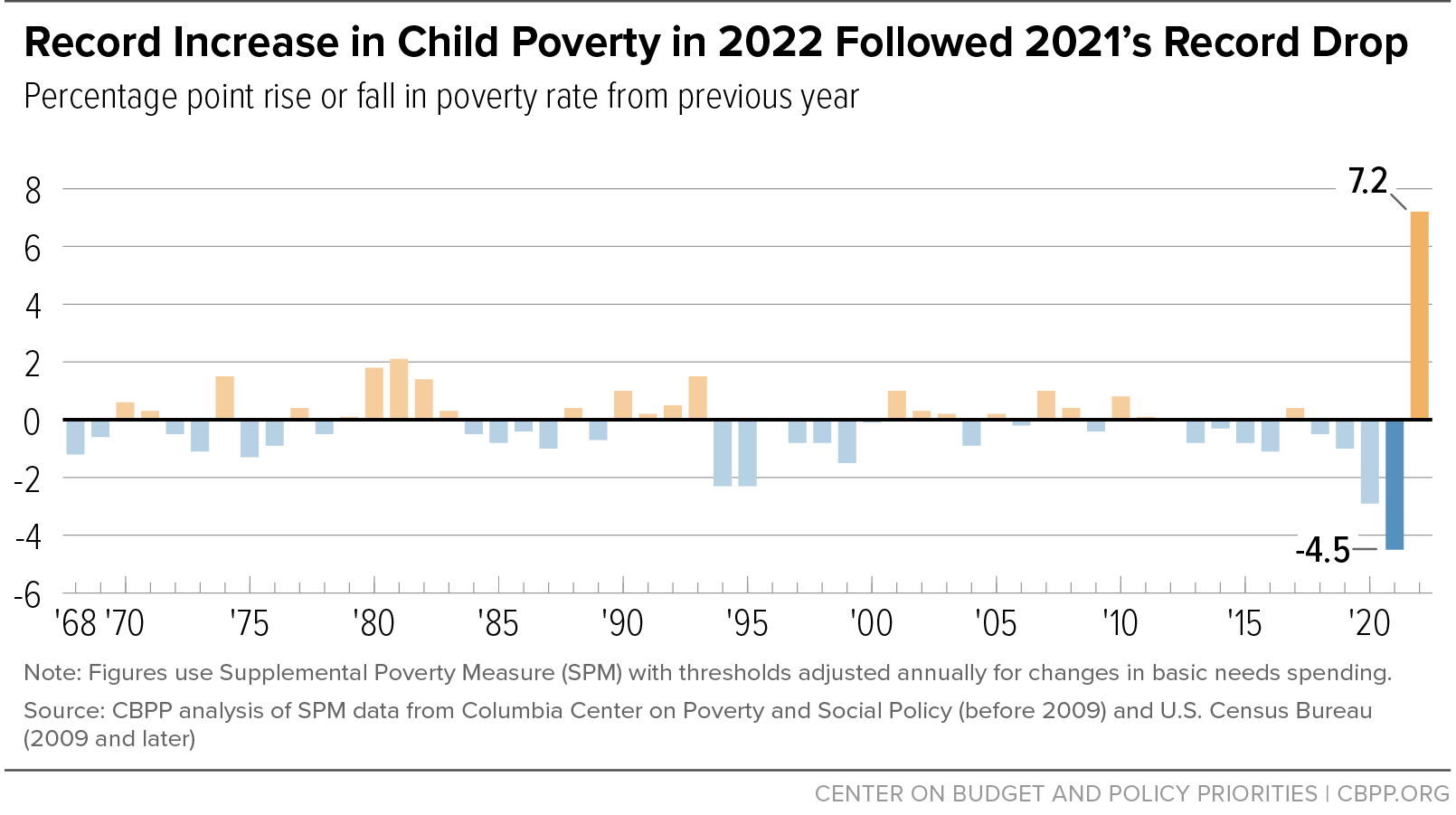

Overall poverty and child poverty rose in 2022 by the largest amount on record both in Census’ SPM data, which starts in 2009, and in our own analysis of SPM data back to 1967, produced by Columbia University researchers. SPM is the broader of Census’ two main poverty measures, as it accounts for taxes and non-cash benefits.

This historic increase in child poverty, by 7.2 percentage points, contrasts sharply with recent progress. It follows two years of historic drops.

2022’s poverty increases were driven by the expiration of the American Rescue Plan’s expanded Child Tax Credit and by the end of $1,400 stimulus payments. The role of the expiring expanded credit, which many policymakers want to again expand, in driving up poverty underscores that the number of children living in poverty is a policy choice.

President Biden has made clear that expanding the Child Tax Credit to reduce child poverty is a top priority, and recently there have been encouraging signs of bipartisan interest. Income supplements like the Child Tax Credit have been found to help children perform better in school and make lasting gains in adult health and earnings.

Sharon Parrott: Record Rise in Poverty Highlights Importance of Child Tax Credit; Health Coverage Marks a High Point Before Pandemic Safeguards Ended

CBPP President Sharon Parrott has commented on today's Census data. Full statement to follow:

“Today’s stunning rise in poverty is the direct result of policy choices — including Congress’s decision to allow the successful Child Tax Credit expansion to expire. Policymakers should expand the Child Tax Credit this year and reverse this troubling trend.

The number of people with incomes below the poverty line in 2022 rose a sobering 15.3 million, today’s Census data show, reflecting the expiration of pandemic relief programs including the expanded Child Tax Credit. The poverty rate for children more than doubled from a historic low of 5.2 percent in 2021 to 12.4 percent in 2022, erasing all of the record gains made against child poverty over the previous two years. Progress made in 2021 in narrowing the glaring differences between the poverty rates of Black and Latino children compared to white children was largely reversed.

The rise in the poverty rate, the largest on record in over 50 years both overall and for children, underscores the critical role that policy choices play in the level of poverty and hardship in the country.

If Congress had continued the American Rescue Plan’s Child Tax Credit increase in 2022, about 3 million additional children would have been kept out of poverty, preventing more than half of the 5.2 million increase in the number of children in poverty last year, CBPP analysis shows; the child poverty rate would have been about 8.4 percent rather than 12.4 percent. Even a more modest compromise expansion this year focused on children with low incomes could have a significant impact and partially reverse the stunning spike in child poverty the nation saw in 2022. Expanding the Child Tax Credit should be the top tax policy priority for lawmakers this year and during the 2025 tax debate.

Pre-tax cash incomes of lower-income households held roughly steady between 2021 and 2022, and the official poverty measure, which only considers pre-tax cash income and excludes resources from the Child Tax Credit, Earned Income Tax Credit, and SNAP, was unchanged in 2022 as compared to 2021. This further demonstrates that the loss of pandemic-related assistance, including the expanded Child Tax Credit, drove the increase in poverty under the more comprehensive Supplemental Poverty Measure, which considers tax credits and non-tax benefits.

Progress on health coverage was a much brighter spot in 2022. The share of people who lack health coverage matched its record low of 7.9 percent, thanks chiefly to pandemic-related Medicaid protections and the Rescue Plan’s enhanced premium tax credits helping people afford coverage, along with expanded marketplace enrollment periods and increased outreach and enrollment assistance.

But some of that progress is now at risk, as Medicaid protections expire. State government data show that about 6 million people have already lost coverage, including many who have not been able to navigate the administrative hurdles required to keep Medicaid. To regain lost ground on coverage, we need to adopt long-term policies and processes that reduce Medicaid coverage disruptions, close the Medicaid coverage gap in states that have not implemented the Affordable Care Act’s Medicaid expansion, eliminate immigration-related barriers to affordable health coverage, and make the enhanced premium tax credits, now slated to expire after 2025, permanent.”