Policymakers Should Expand the CTC

Congressional Republicans may soon release a budget resolution that will set the terms of the tax debate.

Date: February 5th, 2025

Congressional Republicans may soon release a budget resolution that will set the terms of the tax debate, and which is expected to extend the 2017 tax law, including its changes to the Child Tax Credit. But extending the 2017 law would do little for the 17 million children — roughly 1 in 4 children — who currently receive less than the full credit or no credit at all because their families’ incomes are too low. The vast majority of these children are in families who work in low-paying jobs; others are in families who may be out of work due to job loss, illness, or caregiving responsibilities or for other reasons.

As policymakers consider which tax policies — and, by extension, which constituencies — to prioritize in the upcoming tax debate, they should look to the words of their colleague, Senator Josh Hawley. He noted, even as the details of his own Child Tax Credit proposal fall short of his rhetoric, that “for every Republican who went out and campaigned on strengthening families, on delivering for working people… this is the time to deliver.” This should mean delivering a meaningful income boost to children in families who are struggling economically, even if any extension of the 2017 tax law would, as a whole, be costly and skewed to the wealthy.

Under current law, there are three main flaws to the Child Tax Credit phase-in that limit the credit amount for families with low incomes.

- The credit phases in slowly at 15 cents for each dollar of earnings regardless of the number of children in a family.

- Families receive no credit for their earnings below $2,500.

- The 2017 tax law imposed a lower maximum credit amount for families with low incomes, limiting the portion of the credit that families can receive as a refund if their credit amount exceeds their income tax liability. This is often referred to as a “refundability cap.”

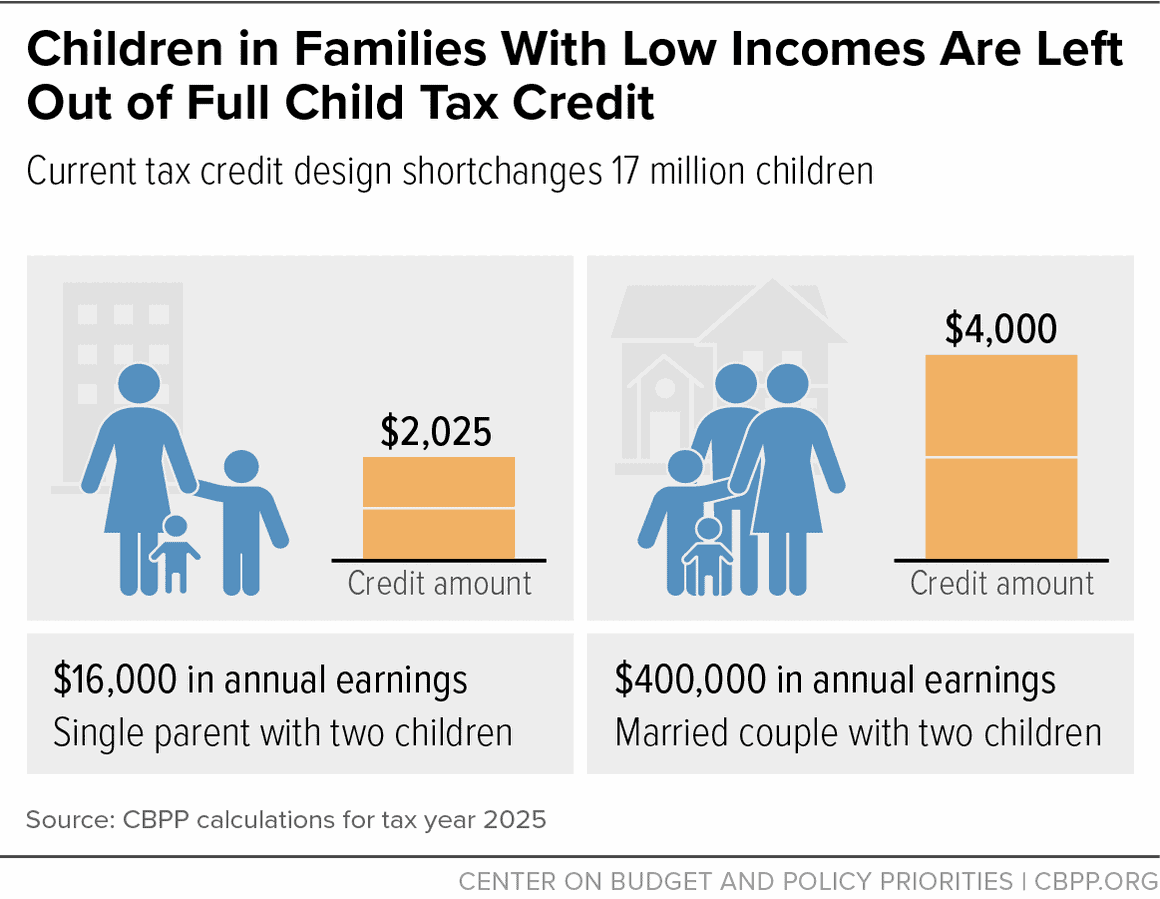

Together, these policy design flaws mean that in 2025, a single parent with two children earning $16,000 as a part-time home health aide receives a total credit of $2,025, or $1,013 per child. Meanwhile, a married couple with two children and earnings of $400,000 receives roughly twice that amount: $4,000, or $2,000 per child.

Research shows that children in low-income families that receive income supports like the Child Tax Credit have better health and educational outcomes during childhood, as well as higher earnings as adults. Yet policymakers currently deny the full credit to an estimated 17 million children across the country.

That 17 million includes more than 4 in 10 Black children and more than 1 in 3 Native and Latino children, whose families are overrepresented in low-paying work due to past and present hiring discrimination, inequities in educational and housing opportunities, and other sources of inequality. Also left out of the full credit are 1 in 6 white children, 1 in 7 Asian children, and all children in Puerto Rico.